Introduction

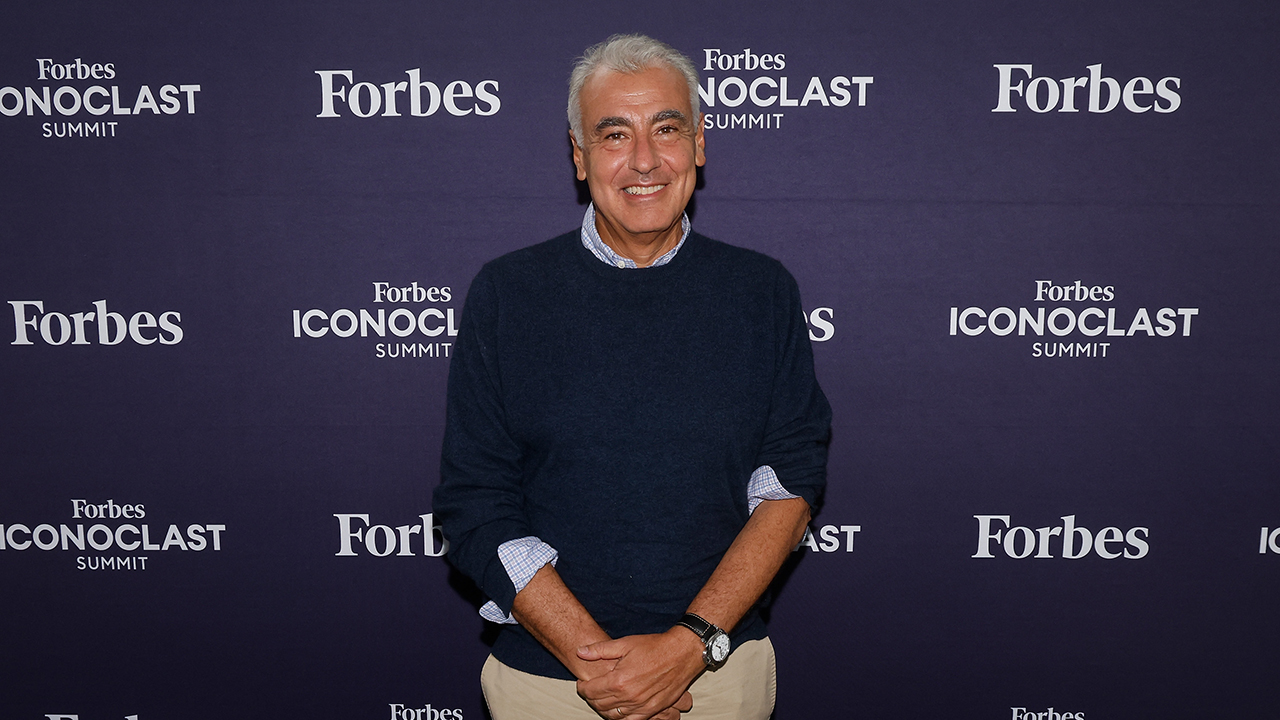

Building an effective investment group is akin to putting together a carefully tuned orchestra. Each member should not only be skilled in their particular roles however likewise work harmoniously with others to attain the typical objective of monetary development and stability. One prominent figure in the world of investment management is Marc Lasry, co-founder of Avenue Capital Group, known for his tactical vision and leadership prowess. This post delves into the subtleties of creating an efficient financial investment group, drawing motivation from Lasry's substantial experience and insights.

How to Develop a Successful Investment Group: Tips from Marc Lasry

Understanding the Structure of a Financial Investment Team

The primary step in building an effective financial investment group is to understand what makes up a strong structure. A well-constructed team needs varied ability, complementary strengths, and shared values.

The Importance of Diversity in Skills

A varied ability makes sure that your group can tackle numerous challenges efficiently. For instance, having experts who concentrate on various markets or industries brings numerous point of views to the table.

- Quantitative Analysts bring data-driven insights. Fundamental Analysts focus on business valuations. Risk Managers examine potential dangers to investments.

This diversity enables thorough analysis and informed decision-making.

Complementary Strengths: Working Together

It's inadequate to have experienced people; they need to match each other's strengths and weaknesses. A good mix of introverts and extroverts can foster much better communication and concept generation.

- Introverts might stand out at research and analysis. Extroverts often shine in networking and relationship-building.

By stabilizing these traits, groups can develop an efficient environment where concepts flourish.

Shared Worths: The Glue That Binds

Shared values amongst staff member create cohesion. When everybody is aligned with the group's mission-- whether it's maximizing returns or sticking to ethical requirements-- it leads to more unified efforts.

Selecting the Right Members for Your Financial Investment Team

Choosing the ideal members is essential for long-lasting success. Here are some crucial considerations:

Educational Backgrounds and Experience

Look for prospects with strong academic backgrounds in finance, economics, or associated fields. However, practical experience frequently outweighs academic credentials. Prospects who have navigated market fluctuations can supply important insights.

Cultural Fit within the Organization

Cultural fit can not be overstated; it influences how well brand-new members will integrate into your existing group characteristics. Carrying out character assessments throughout interviews can assist determine compatibility.

Track Record in Previous Roles

Candidates must have demonstrable results from previous roles. Inquire about specific achievements and how they contributed to their previous teams' success before joining your firm.

Establishing Clear Roles and Responsibilities

Once you have actually assembled your team, defining clear functions is essential for efficiency.

Defining Leadership Positions

Leadership within an investment team normally consists of functions such as Portfolio Manager, Research Analyst, and Danger Supervisor. Each leader ought to plainly understand their duties:

Portfolio Managers make final financial investment decisions. Research Analysts offer essential data support. Risk Managers implement strategies to alleviate losses.Creating Responsibility Structures

Accountability motivates obligation amongst team members. Implementing regular efficiency reviews helps track progress versus specific objectives while cultivating an atmosphere of shared respect.

Fostering Open Communication

Communication is the lifeline of any successful organization.

Encouraging Idea Sharing

Create a culture where every voice matters by encouraging open discussions throughout meetings or brainstorming sessions. This not just generates innovative ideas however also strengthens relationships among team members.

Utilizing Innovation for Better Communication

Tools like Slack or Microsoft Teams assist in real-time communication, specifically if your group runs remotely or across various locations.

Developing a Strong Financial investment Strategy

An effective technique offers direction for your team's efforts.

Aligning Strategies with Market Trends

Stay updated on market patterns by performing regular analyses that align with your investment philosophy. Marc Lasry emphasizes versatility; groups must change their methods based upon emerging economic conditions or unexpected occasions like pandemics or geopolitical shifts.

Incorporating Danger Management Practices

Risk management should be important to your method. Develop requirements that help determine possible dangers before they escalate into larger issues impacting general portfolio performance.

Continuous Learning and Development

Markets evolve quickly; thus constant learning needs to become part of your team's culture.

Investing in Training Programs

Encourage staff member to attend workshops, webinars, or pursue certifications that improve their understanding base-- particularly areas like data analysis tools or behavioral financing trends that may affect investment decisions.

Promoting Knowledge Sharing Among Team Members

Regularly schedule internal workshops where staff members can share current findings from conferences or short articles they have actually checked out-- this promotes cumulative growth within the organization while keeping everybody notified about industry advancements.

Building Trust Within Your Team

Trust is foundational for high-performing teams; without it, Marc Lasry biography partnership suffers significantly.

Transparency in Decision-Making Processes

When choices are made transparently-- with extensive descriptions supplied-- team members feel valued and trusted which cultivates commitment towards one another as well as towards organizational objectives laid forth by leaders like Marc Lasry at Avenue Capital Group who thinks trust manifests through transparency.

Conflict Resolution Mechanisms

Address conflicts head-on instead of letting them fester below the surface. Developing clear protocols regarding how disagreements oughta be fixed will guarantee problems do not disrupt efficiency over time.

Measuring Success: Key Efficiency Indicators (KPIs)

How do you know if your financial investment group achieves success? By executing KPIs customized specifically towards evaluating efficiency successfully, organizations can track progress over time:

|KPI|Description|| -----|-------------|| Return on Investment (ROI)|Procedures profitability relative investments made|| Alpha|Indicates fund supervisor's performance compared market benchmarks|| Sharpe Ratio|Evaluates risk-adjusted return results|

These metrics supply important insights into both private contributions as well overarching efficiency attained collectively.

FAQs About Constructing a Financial Investment Group Motivated by Marc Lasry

What qualities must I try to find when hiring?

Focus on candidates' abilities appropriate finance together with cultural fit within existing group dynamics; prioritize experience over formal education where appropriate.

How often needs to we hold meetings?

Regular check-ins-- preferably weekly-- enable tracking development while facilitating open dialogue surrounding ongoing tasks among all included parties.

Is it essential to have actually specialized roles?

While specialization helps improve tasks, versatility among team members enables flexibility towards shifting demands situationally experienced within busy finance environments.

How do we make sure accountability?

Implement structured evaluations along with goal-setting efforts developed promote ownership among people concerning both successes failures incurred throughout procedure timeline.

Should we purchase technology?

Absolutely! Modern tools improve communication efficiency while providing analytical capabilities critical examining evolving market conditions impacting decision-making processes carried out frequently by teams alike ours here Avenue Capital Group.

What does success appear like for an investment team?

Success incorporates accomplishing set financial goals together with cultivating unified relationships among associates motivating growth individualistically collectively alike throughout board!

Conclusion

Building a successful investment group isn't practically hiring skilled people; it's about producing a community where those skills can grow together harmoniously towards shared objectives-- an approach embodied by market leaders such as Marc Lasry at Avenue Capital Group whose dedication excellence resonates deeply throughout all facets operations conducted therein daily basis. Investing time effort into shaping this environment will unquestionably yield fruitful results both financially personally allowing continual growth future undertakings alike!